South Florida Real Estate Blog

Learn the entire process of buying and selling properties in South Florida. Whether you're an investor, a first-time buyer, looking to sell your property, or just curious. In this guide, you'll get a step-by-step overview, costs, strategies, common mistakes, types of investments, and much more.

Affordable Property Updates

Boost your property's value with low-cost changes: new knobs, fresh paint, updated fabrics, clean spaces, plants, and smart curb appeal. Avoid costly renovations—you likely won’t recover the full cost when pricing your home. Focus on market value.

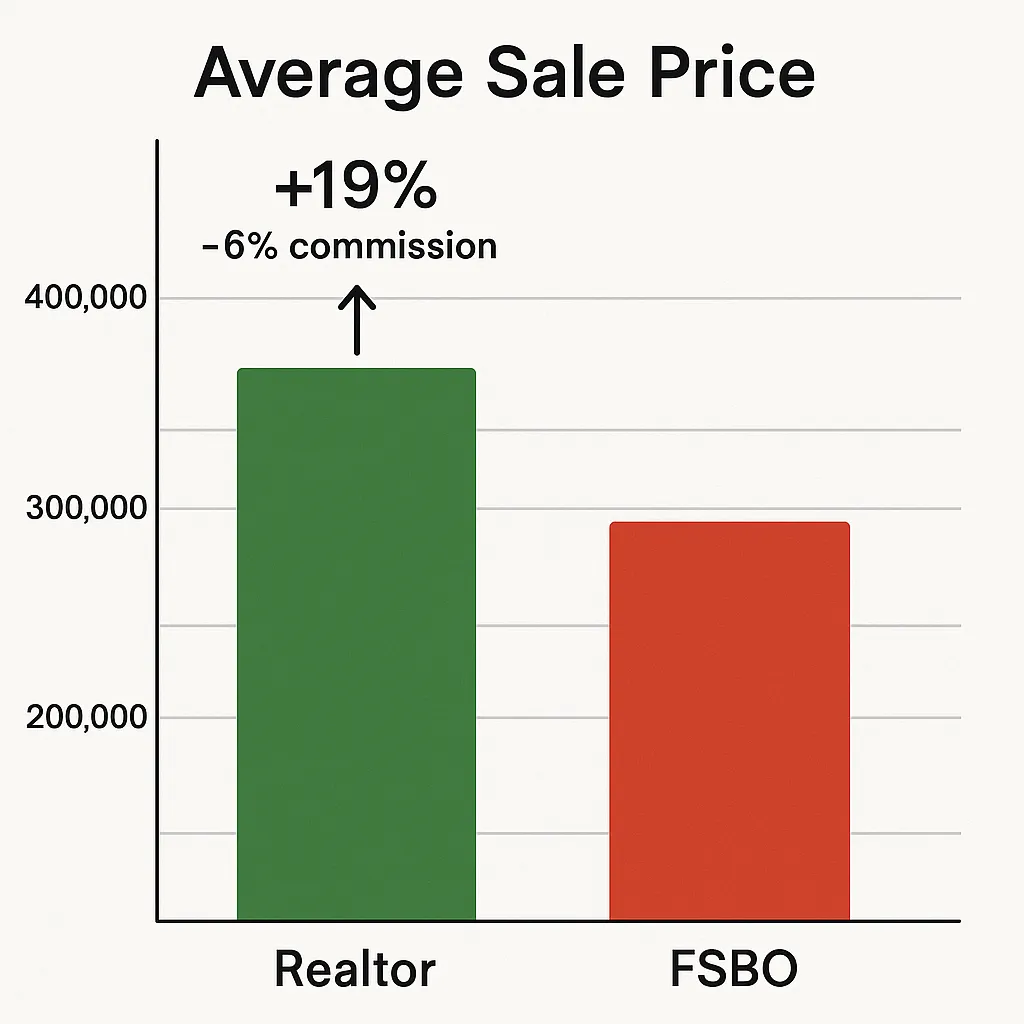

Commission: Seller Agent

In South Florida, sellers usually pay a 6% commission, split between both agents. FSBO sellers often earn 13% less after missed marketing and pricing opportunities. A Realtor offers legal, financial, and strategic support that pays off.

For Sale vs Sold

Selling a home requires more than just listing—it takes smart pricing. Avoid common errors like overpricing, and use recent sales, market data, and appraisals to set a competitive price that attracts serious buyers and multiple offers.

Pick the best Realtor

Choosing the right agent is key to selling your home successfully. Interview multiple Realtors, ask about local experience, pricing accuracy, marketing plans, communication, and references to ensure you're working with a trusted professional.